CMF

Leasing

We put at your disposal the most used long term financing tool worldwide in capital assets investments.

What does Leasing mean?

Leasing is the most modern and versatile tool in order to finance equipment incorporation: by paying a periodic fee for the asset use, with a final purchase option.

It is the most powerful long term financing tool, used worldwide to accompany capital assets investments.

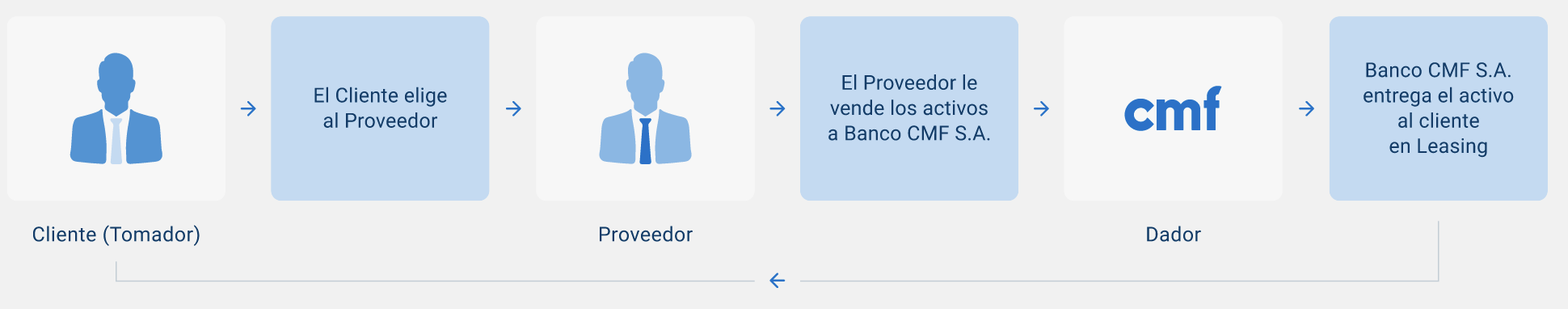

How does CMF Leasing work?

Types of Leasing

Advantages of Leasing

Leasing does not tie up capital

By signing the contract, the Bank buys the asset and finances it through Leasing.

VAT Discrimination

As the Bank is the initial buyer of the good, the Client pays VAT by installments along the contract validity.

Leasing facilitates procedures for imported goods

As the Bank is the buyer, the Client delegates all procedures related to importation of the required good.

Leasing optimizes available balance management

As the good is not part of the asset, and by discounting the fee along the contract validity, Income Taxes are deducted in advance.

Leasing is suitable to each client and each operation

In Leasing, the contract Schedule can be suitable to each Client´s needs.

Accessible Requirements

As this is a loan with in-rem warranty, it is easier to be processed.

CMF Leasing Value

- Client as the center of the business

- Efficiency

- Personalized attention

- Easy Management